U.S. National Debt

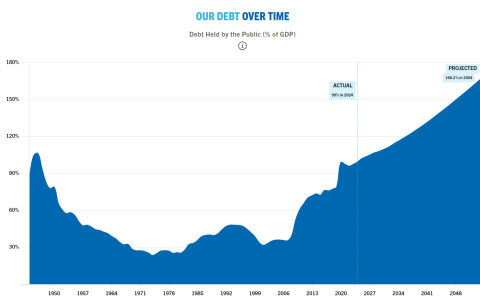

Every year I feel it is important to highlight a growing problem that may impact standard of living in the United States. The U.S. national debt is over $30 trillion and growing. While it is less of a problem for us then it is for our children, the U.S. debt has consequences for all of us. Countries that have balanced budgets tend to be more stable over the long-term. The solution to the national debt? More taxes, less spending, or long-term higher inflation. Might it be that we are seeing inflation in someways is impacted by current debt levels? It might be the case. The U.S. debt impacts how we invest monies as it does make us a bit more cautious on the overall economy. Let’s hope at some point in time those in power address this issue; it is important. A recent article highlighted the U.S. debt. An excerpt is provided below.

***

Begin quote

“America's growing debt is the result of simple math — each year, there is a mismatch between spending and revenues.

When the federal government spends more than it takes in, we have to borrow money to cover that annual deficit. And each year’s deficit adds to our growing national debt.

Historically, our largest deficits were caused by increased spending around national emergencies like major wars or the Great Depression.

Today, our deficits are caused mainly by predictable structural factors: our aging baby-boom generation, rising healthcare costs, and a tax system that does not bring in enough money to pay for what the government has promised its citizens.

The coronavirus crisis has accelerated an already unsustainable fiscal trajectory, both because of its devastating effect on the economy and the necessary legislative response. Moving forward, it will be critical for America’s leaders to address our rising debt, and its structural factors, which are described below.

End quote

Source:

https://www.pgpf.org/national-debt-clock