Market Sell-Off

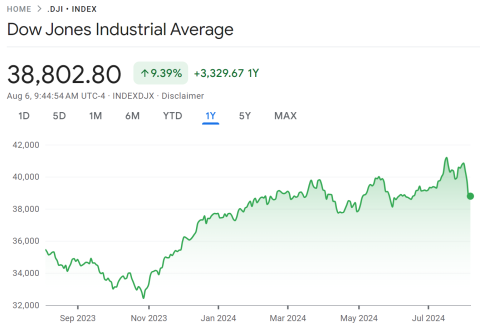

The markets got off to a very difficult start on Monday as investors appeared to be reacting to a weaker than expected jobs report. Concerns about a global slowdown also weighed upon investor sentiment.

The drop in equity markets erased some of the gain made over the last 12 months. Still, this has been a reasonable year in terms of returns. See the chart below.

Chart source: https://g.co/finance/.DJI:INDEXDJX?window=1Y

KCBS reached out to me Monday and asked me to comment in a 15-minute interview about our thoughts about the market drop. I think you might find this interesting. You can listen to the interview here:

https://destinationwm.wistia.com/medias/g0y3m7m5b7

It’s not time to panic in our view. Despite a slowdown, I don’t see the US economy tumbling into a deep recession. We will continue to monitor data, but at this point we expect that a shallow recession or a soft landing are the most likely outcomes.

Disclosures: The Dow Jones® Industrial Average℠ (DJIA) is a price weighted benchmark index composed of 30 “blue-chip” U.S. stocks, measuring the daily price movements of American companies on the Nasdaq and the New York Stock Exchange. The DJIA represents companies chosen from all the major sectors of the economy except for the transportation and utility industries. The DJIA is price-weighted, which means stocks with higher share prices are given greater weight in the index.

DWM currently holds Apple Inc. (AAPL) in DWM managed portfolio strategies.

Indexes mentioned are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses. Index returns are in no way a reflection of the returns of a client portfolio and are not presented as a comparison of performance.