The Election and Stock Market

Election!

Happily, the election is almost here. All the drama, the controversy, the noise, will hopefully start to settle down a bit after the election. I suppose we will see.

A recent report outlined what tends to happen during presidential elections. I’m providing the information for you below for your review. It is nonpartisan!

***

Begin Quote

“A historical look at presidential elections’ impact on the stock market

Using the average 3-month returns following each election outcome—and comparing those with the average 3-month return during the full analysis history—strategists calculated the statistical significance of the relationship between political control and market performance using a calculation called a t-statistic, or t-test.

Results of the analysis contradict conventional wisdom that a Republican or Democratic “sweep” of the presidency and Congress is most likely to cause market disruption. In fact, historically there has not been a statistically significant relationship between single-party control of both the White House and Congress and market performance.

Rather, the data uncovered three divided-government outcomes with a statistically significant relationship to market performance.

Two scenarios corresponded to positive absolute returns in excess of long-term average returns:

- Democratic control of the White House and full Republican control of Congress.

- Democratic control of the White House and split party control of the Senate and House.

One scenario corresponded to positive absolute returns modestly below long-term average:

- Republican control of the White House and full Democratic control of Congress.

Source: U.S. Bank Asset Management Group

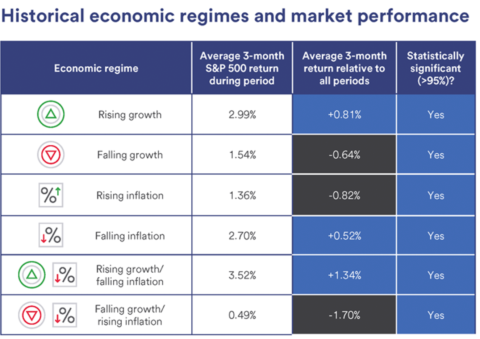

The historical data suggests that economic and inflation trends, more so than election outcomes, tend to have a stronger, more consistent relationship with market returns.

In general, rising economic growth and falling inflation have been associated with returns that are considered above long-term averages, while falling growth and rising inflation have corresponded to positive but below average market returns. For investors, staying focused on these patterns is probably more insightful than potential election outcomes when it comes to forecasting market performance.

Source: U.S. Bank Asset Management Group

While the analysis doesn’t point to elections having a meaningful medium-to-long-term market impact, they could affect individual sectors and industries. Different election outcomes have the potential to affect proposed policies, regulations, or global conflicts.

The following are policy issues to monitor throughout the presidential nomination and election process:

- Individual and corporate tax policies, including state and local income tax (SALT) deductions

- Spending priorities, such as energy, infrastructure and defense

- The future of programs such as Social Security, Medicare and Medicaid

- Health care policy, including the future of the Affordable Care Act

- Regulation

- Immigration policy

- China, including the potential for additional tariffs on Chinese-made goods

- Geopolitical conflicts (Russia/Ukraine, Israel/Hamas)”

End Quote

Source:

https://www.usbank.com/investing/financial-perspectives/market-news/how-presidential-elections-affect-the-stock-market.html

***