CPI Inflation Levels

Thankfully, consumer price index levels appear to be moderating. Inflation is a major risk as well as the resulting action by the Federal Reserve.

We continue to be underweight duration relative to the market and we believe that's appropriate positioning given inflation uncertainty. We still have to see what tariffs and tax cuts will do to economic growth; we need to be cautious as they could be significant inflationary triggers.

A recent CNBC article highlighted the drop in CPI. See excerpts below.

***

Begin Quote

“Prices that consumers pay for a variety of goods and services rose again in December but closed out 2024 with some mildly better news on inflation, particularly on housing.

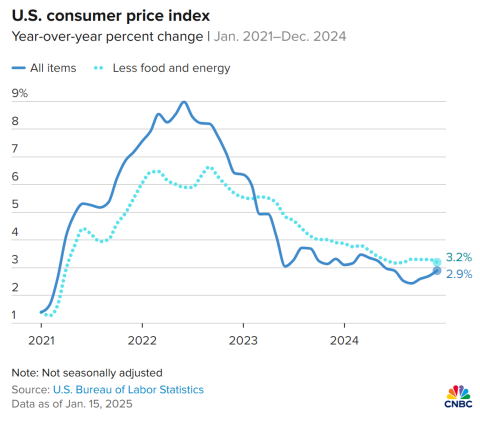

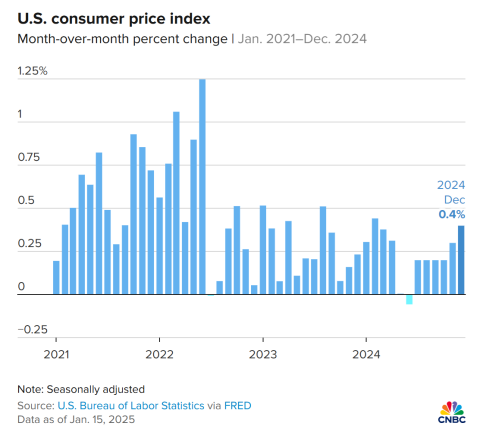

The consumer price index increased a seasonally adjusted 0.4% on the month, putting the 12-month inflation rate at 2.9%, the Bureau of Labor Statistics reported Wednesday. Economists surveyed by Dow Jones had been looking for respective readings of 0.3% and 2.9%.

However, excluding food and energy, the core CPI annual rate was 3.2%, a notch down from the month before and slightly better than the 3.3% forecast. The core measure rose 0.2% on a monthly basis, also 0.1 percentage point less than expected.

Much of the move higher in the CPI came from a 2.6% gain in energy prices for the month, pushed higher by a 4.4% surge in gasoline. That was responsible for about 40% of the index’s gain, according to the BLS. Food prices also rose, up 0.3% for the month.

On an annual basis, food climbed 2.5% in 2024 while energy nudged down by 0.5%.

Shelter prices, which comprise about one-third of the CPI weighting, rose by 0.3% but were up 4.6% from a year ago, the smallest one-year gain since January 2022. Services prices excluding rents rose 4% from a year ago, the slowest since February 2024.”

End Quote

Source: https://www.cnbc.com/2025/01/15/cpi-inflation-december-2024-.html