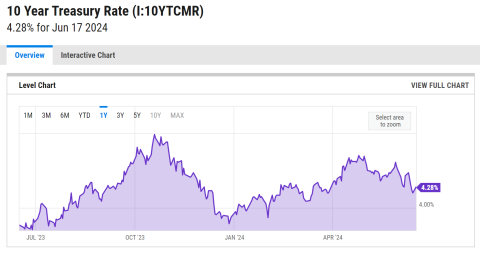

10-Year Treasury Yields

The direction of interest rates is directly tied to inflation numbers. As of late, inflation seems to be moderating which is why yields have dropped so significantly on the 10-year treasury. A recent article highlighted this drop in rates. See excerpts and a chart below.

Chart source: https://ycharts.com/indicators/10_year_treasury_rate

Data as of 6.17.24

***

Begin quote

“Last week, the yield on the benchmark 10-year Treasury note fell 21 basis points, to 4.22%. And it’s been falling since it peaked back in late April at 4.88%.

Generally speaking, it’s a pretty good thing when interest rates fall. It’s good for stocks because it means it’s cheaper for companies to borrow and invest. It’s good for housing because lower mortgage rates mean more people can afford to buy. It’s good for consumers because they can buy more and pay less on their credit cards.

But why is it happening now? It’s all about the Federal Reserve and what investors think the Fed will do next.”

End quote

Source: https://www.marketplace.org/2024/06/17/bond-prices-up-treasury-note-yield/

***

It’s hard really to predict how fast the Federal Reserve will ease. It’s dependent on a number of data factors which are not obvious at this moment.

Our original thesis that rates would drop three times this year is now changed to one time this year and likely in the fourth quarter. The Fed has stated that they are looking carefully at inflation data to make a judgment of what their actions should be. They are hinting that nothing will happen prior to the fourth quarter.

One thing to keep in mind. Projected interest-rate policy does impact current interest-rate levels. If you look at the pricing of bonds by the bond market, you will see that already there has been essentially a cut in interest rates as indicated by the treasury market.

It does look like inflation is moderating slightly. We will continue to watch the data points to see if this trend continues.